Pip Tee

Forex Trader and Mentor

Saturday, February 26, 2011

Take your loser's like your winners

This was a trying month for me personally, financially and mentally. Why? The Eurusd went into a consolidation on the 15th and 16th which caused me to take the longest string of losers I have ever had the joy of experiencing. Some of you took them with me. I wanted to talk about these because most people NEVER talk about the loser's they take, only the winners. I want full disclosure, good or bad, I want you all to know what is happening, the mistake I may or may not make. Your never know when or what can be learned.

My personal view when it comes to trading is to not focus on the money associated with the lot size. If I take a losing trade, it will cost me anywhere from 36 pips to 100 pips. The dollar amount of those pips do not matter to me because I know my trade model to be profitable over time. You all hear us talk about having a positive RR ratio of 2:1 or better. This means to me that I can take 2 losing trades before I am at the original account balance.

I wrote an article about having the right ratio here: Euodootrading.com

Following the proper ratio helps me stay focused even when I have to take a losing trade. When I catch a runner or a winner, I let it work and pay me as long as it wants. We all heard the saying "Let you winners run," the real question is Do You?

Losing trades are apart of trading. If you can't take a loser, then... I don't know what to tell you. Now, I can take a loser, I can take two losers in a row, 7 in a row and I'm feeling a lil sick. I still have faith in my trade but there comes a point where I have to either step away, stop trading or look closer at what is going on. When I have to take that many loser's in a row on the Eurusd, then I know its in a tight channel, at some point it is going to break out and run like crazy. I have to be prepared to make my money back, and that is exactly what happened this month. We took some losers or quite a few losers for that matter, but was able to make them back and be in profits to end the month. THAT is the power of having a positive risk to reward ratio.

I do take losing trades, its how I manage my winning trades that more then make up for a loser. Proper management of risk, positions and reward ratio all play key factors in being profitable.

Be Profitable.

Wednesday, January 26, 2011

Opportunity Cost Lost

Let's take the first one: "The market will never hit my stop if I move it 20+ more pips."

Really? No, REALLY? The market can do whatever she wants when she wants. A properly placed SL should never be touched after its set. You pick that area for a reason, stick with that reason because during live trading, nothing is going to change that will make you NEED to change your SL.

Ever hear of the SL Hunt? It happens, what do you think those wicks are? If you are the kind of trader that feels the need to move their SL farther back in the middle of a trade, the simple solution is to build in a 10-15 pip buffer or call me. I can give you may account number and you can wire the money you are about to lose to me. If your SL is 40 pips, make it 50, 55 and build THAT SL into your risk. I had to do that with my GBPCHF trade. I originally had a 90 pip SL and kept getting taken out by a pip or 2, I forgot to add broker spread. My new SL is 100 and that has allowed me to catch these 200, 300, 800 pip runs.

Yes a 100 pip SL is crazy I know, but I don't care when I'm going for 2:1+ returns. The SL to me doesn't matter if as long as my RR is what its suppose to be.

Now time for my biggest issue: "I'll move BE and have a free trade."

I think this comes from being over protective. My true rule on moving BE is to not do it until I'm up 2:1+. I tend to move BE around 50-60 pips which is only 1.25-1.5:1 which is way to soon. Once a month I tend to do this and get taken out by 1-2 pips, then it shoots to the moon. When I don't touch it, like I'm suppose to, I can catch 150-1000 pip runs out of the Eurusd pretty easily.

So what is my problem? My wife always says "Leave it alone. You spent years studying that trade, and you continue to make the same mistakes. Your a great trader, LEAVE IT!" Of course I don't like being told what to do, I'm a stubbon Boricua, but @tradercisco tells me the same thing when I make the same mistake. Granted I have been getting better with this, but I think I am still guilty of doing this at least once a month. This for me is one the the last things that I personally have to work on.

This week I missed out on catching the eurusd long from the 3466 entry that went and paid 200+ pips. 5.5:1 return that I missed = an Opportunity Cost Lost that was huge because the next two eurusd trades failed. Had I caught my trade and not moved BE to soon, I would have had plenty of money and pips to cover the two losing trades. 72 pips lost-200 pip gain=128 pips or 3.5:1 RR. Time's that by 2% risk and I would be sitting pretty with about 7% gain. But NOOOOO, I had to mess with my trade and am -4%. I always say lesson learned and this time I will never forget this trade. (Yes I say that all the time too).

You see where I'm going with this? As @nictrades said in her interview: "Your stop is where your trade fails." So why would you moved your stop farther against you, or move it to soon. My trade mistakes cause me to fail, not necessarily losing money, but I didn't make any money and in my book that's worse then losing.

Opportunity Cost Lost is a big deal to me as I grow as a trader. If I am not aware of it and what I am doing, my account can and would go in the wrong direction. Thankfully with my journal I am able to see exactly what is going on with myself and correct what needs correct and build on the strengths that I do have. My patience is getting a lot better thanks to the egg timer, now the itchy SL finger needs to be adjusted. Time will tell.

Piptee

Sunday, January 23, 2011

Journal for 2011

I am already seeing patterns in my trade and how I trade them. My flaws are sticking out like a sore thumb and its funny to see what I write about myself and how I can improve, then make the same mistake on the very next trade. Only to write the same thing I wrote for the previous trade.

"Do not move your stop. Take profits if you feel antsy or your patience is waning"

I need the teacher that will force me to write that sentence 50 times on the chalk board. I have written that above sentence about 3 times already this year, and I've only been in 7-8 trades so far.

"Your stop is where your trade fails." (Like we never heard that before)

"Only move your stop when you are up 2:1+ RR" (Can you tell I have an issue with my SL?)

That's just a few bullet points from what I have had to write in my journal so far. So why should you care about my journal our what I'm writing? It would be nice to publish my journal at the end of this year. Self publish, book publisher, I don't care. I think the journey in itself will be an eye opening experience for myself and maybe others.

We all tend to have the same issue's from time to time when it comes to trading, how each of us deal with them can be beneficial to others. I talk with @tradercisco, @50pips and @kosentrade all the time about trading and the emotions that come with it. I'm sure you have seen the "Get @piptee some midol" tweets from time to time. I don't like to fail and tend to beat myself up when I fail the trade. A trade failing I can handle because that is something we have no control over, but when I fail the trade by moving BE to soon, not taking profits etc, I get emotional at myself.

I will keep you all up to date on the progress of my journal, maybe even put some of it out there for you all to see. I would really like you all to stay on top of me also, don't let me fail you.

PipTee

Sunday, January 9, 2011

Friday, October 1, 2010

September Skky Trade Results

I was happy getting back to the trading style that I am used to. I think I got my trading mojo back. I tried a different method that just would not fit my trading style or success rate that I want to have. My emotional trading style is better suited for a set it and forget it.

I have been working on Skky trade for awhile now and am happy to see the results that I was kinda expecting. Below you will see the video journal that I did showing the trades that happened this month and the profits it generated.

If you would like to see how you can take the same trades on your account, sign up for our Black Box test group today: http://euodootrading.com/black-box-beta-program-signup/

Monday, August 2, 2010

Aug 2nd trading day

So I’m going to start journaling my trades on my blog, mainly to keep me honest in doing it. I have a journal note book that I use, but should my house catch fire and burn to the ground, at least I will have this as a record for me to look back on.

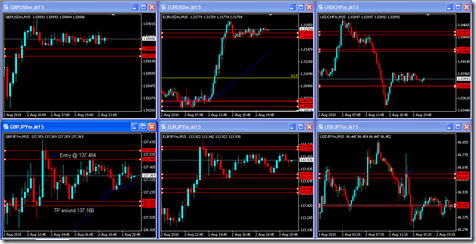

On to the trade. I personally like to wait for the good trade to come to me before taking it, and patience paid off for me today. I follow the old school rules of a confirming trade with my own little spin of wanting 30+ pips to next move/target. So when I saw the GJ, EJ an UJ all confirming, I didn't hesitate and got a perfect to the pip entry.

On to the sucky part of the trade. I closed 80% around 11, 12 pips I think, which is a HUGE no no, plus I’m still getting used to these 5 numbers. You can get excited when it “looks” like your up 130 pips lol. I did it cause I was watch UJ and it was floating around its lower targets, so I wanted to make sure I bagged some pips just in case it held and went north on me. I closed more around 20 pips then moved BE. It came back on me and took me out by the freakin fifth number this time, but whatever.

What did I learn:

- Only close a 80% at target for the pair you are trading, make sure its over 20+ pips when you TP.

- After 20 pips, move stop –10 and leave it.

Thursday, March 25, 2010

The “Secret” Trade

I am a big believer in “The Secret.” Have you seen the movie yet? If not I strongly suggest you watch it. I watch it at least once a week to stay on track. The “Secret” is the Law of Attraction. Napoleon Hill wrote about it in Think and Grow Rich, another book that I try to read once a year during vacations.

I first saw something about “The Secret” on Oprah. I know, I know, but that day changed my life for sure. I was broke, had about $10 in the bank and had no clue where the next dollar was going to come from. I watched that movie and used the last bit of money I had to buy it. I watched it, took notes and applied the Law of Attraction that day. It was a Monday and I wanted to have $5k by Friday because I had to go to California Friday night. So every morning I applied the Law of Attraction, calling $5k to come to me and having total FAITH that I would get it. Thursday I got a call to do a job and Friday morning I picked up a check for $4800. It wasn't $5k, but it was close enough.

That day changed my life and belief in how I can attract what I want. I did that exercise of attracting money into my life a few more times and stepped up my requirements. For a few months I was attraction $20-30k a week and working less and less, the other aspect of what I wanted for myself: more money and less work.

Not quite sure what I was attracting to myself when Barry called and said I was going to learn how to trade currency with him, but years later what I wanted, what I attracted to myself was to work less and make more money. So now I am a trader, a successful trader, and I'm humble about it ;)

So now that we have that out of the way, it’s time to talk about “The Secret Trade.” When you get into a trade do you HOPE it will pay out? Hope is a belief in a positive outcome related to events and circumstances in one’s life. You can sit there and hope all day long, but there will be a feeling or thought that something will go wrong, the trade will fail. Negative thoughts creep in when you hope, and a negative thought is twice as powerful as a positive thought.

So what happens when you have faith in the trade? Wikipedia' says faith is a confident belief in a concept or thing. I like the bible definition better. Hebrews 11:1 says “ Faith is the assured expectation of things hoped for, the evident demonstration of realities though not yet beheld.” Did you notice how we need to have faith to go along with hope?

Are you seeing where I am going with this? I feel that you can “Attract” trades to you. Patience and faith are so important when it comes to trading. When I get in a trade, I try to put myself in an emotional state of what it will FEEL like when I get paid out. I try to have total faith in the trade and don’t even think about it failing. If you doubt your abilities as a trader, your account will very quickly reveal it. Confidence, trust and faith are the ONLY emotions I think a trader should have and focus on while they are sitting at the desk trading.

The Secret: “Attract positives pips, and you will get them”