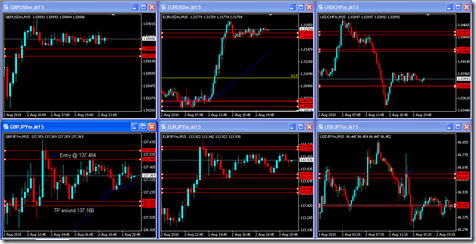

So Euodoo got us in on the sells for the EURJPY and also gave us opportunities to cost average, which some traders took. I know I did and by the time the original entry started to pay about 40 pips I was up around 90 pips. That was close to 1:1 returns so I closed out the majority of both entries and moved my stop -10 on the original entry and BE on the cost. Needless to say I was stopped out of both but with profits.

The GBPJPY on the other hand wasn't so nice to us. We took about a 100 pip loss, which basically took our profits from the EURJPY trade. My rule when I get stopped out of this trade is to flip it, double my lots and head the other direction. So that is what I did. Euodoo will get you in on the flip, but it will not increase your lots. I am looking to have that added to the next version on Euodoo and we will probably have it by next week.

Let's take a second and talk about doubling lots. My risk on every Euodoo trade is around 1-1.5% of my account. That way of the trade fails I am looking to add 2-3% on the flip. I never risk more then 3% on any given trade. So you are probably asking yourself "What if the flip fails?" Well I have only had that happen to me on the USDJPY, which id one reason why I do not trade this trade on that pair. If memory serves the 3rd flip would have paid out, but I don't like wishy washy trading so I just stay away. Rarely, in my studies, has it failed twice in a row, that is why I am comfortable flipping it. Time will tell.

Back to the GBPJPY. I saw about 40 pips on the flip, closed half and moved BE, as Im typing this it just stopped me out. But that is fine. Ended the trades positive only a few pips because the EURJPY and GBPJPY washed each other out. ( But keep and eye on the GBPJPY, it will most likely get into the 146 area today and you might be paid about 100 pips or so.)

Euodoo also got us in going long on the AUDJPY yesterday with an entry at 80.73. It is against us right now, but I am not to worried. As I looked at the day, I noticed it came and tapped two trendwall lines that intersect each other. That is a Treasure Map trade that I learned from @tradercj. (I would follow him if he lets you.)

What is a Treasure Map trade you ask? Stay tuned, I'll teach you. Just keep and eye out on AUDJPY, let's see if we get a bounce up. (Watch it fail because I said something=)

Ok, so that is the recap. We washed out of two trades with a lil profit, and we are sitting negative about 40 pips in AUDJPY. Waiting for next set up now, so DELETE Euodoo from your charts. This is what I do so I can start fresh when new numbers come out.

I probably could recap what Euodoo did on Monday. Think we took about 100 pips on GBPJPY, so we are up for the week. I know @tradercisco is up 50% in his Euodoo account. He was trading it better then I was.

Keep following @Euodoo because we are going to be holding a webinar very soon on what Euodoo is, how to trade it successfully and a bunch of other useful tips. Let us know if you need Euodoo also.

Thanks all.

Pip Tee