I have been trading with Tim Chandler lately and have been getting schooled in Price Action. I wanted to let everyone know what I have been learning.

1. Correlating Currencies

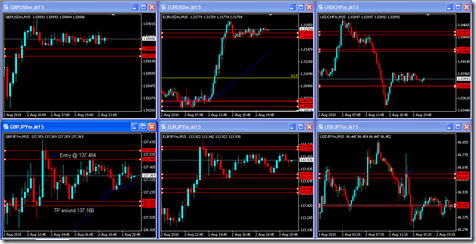

When the currencies pairs are all following the rhythm of each other, it is very important to WAIT for the pairs to all hit their targets. I learned this lesson on a losing trade this week. I bought the Eurusd when the Eurjpy had not hit its reversal target/area yet. So my Eurusd dropped a little more stopping me out. Once the Eurjpy settled at a reversal point, the Eurusd followed suit and I was able to buy it again and get back to BE.

Patience is so key in trading. Let the trade come to you, there is no need to force anything. If the set up is not there, wait. There is nothing wring with not taking a trade, then to force a trade, lose then want to revenge trade to get the lose back. Not a good way to trade at all.

2. Limits and Return Ratio’s

If you have a trade that has high success rate’s and pay 1:1 returns, I think it’s a safe bet that you will be successful. But what if you have a high success rate and can get more then 1:1?

The lesson in setting limits was a good one. I learned this on a one on one phone call with Tim. (One of the perks of trading with Tim.) If you cannot watch a trade, set a 20 pip limit. If you can manage the trade, don’t set a limit. Leave the entry open and see if you can get 30, 40 or more pips out of it. Nothing wring with closing a portion at 20+ pips and moving BE to take profits. You HAVE to take profits. Can’t let a trade that pays out turn into a loser.

3. Risk

Risk only .5% on trade that may set up but are not the “Perfect” trade, and load up to 1-2% when it does. An example of this was on the guppy this week. About 20min after the webinar ended the guppy(GBPJPY) set up as a picture perfect confirming trade. It paid out over 60 pips. 20 pip stop:60 pip payout. 3:1 return. If you loaded up to say 2%, you would have yielded 6% payout.

This is a combination of not setting a limit and loading up. These trade present themselves and we see them almost everyday and almost every session. Bring the risk down when you don’t have the “warm and fuzzy” feeling, and load up when you do.

So those are three points that I have found beneficial to not only trading with Tim, but with my trading in general. Correlations, letting the runners run and controlling risk are all key components to trading.

The next blog I am going to focus on is taking full loses and half winners.

Hope you all have a good weekend. I know I have to get back to blogging and posting, I will step my game back up.

Pip T